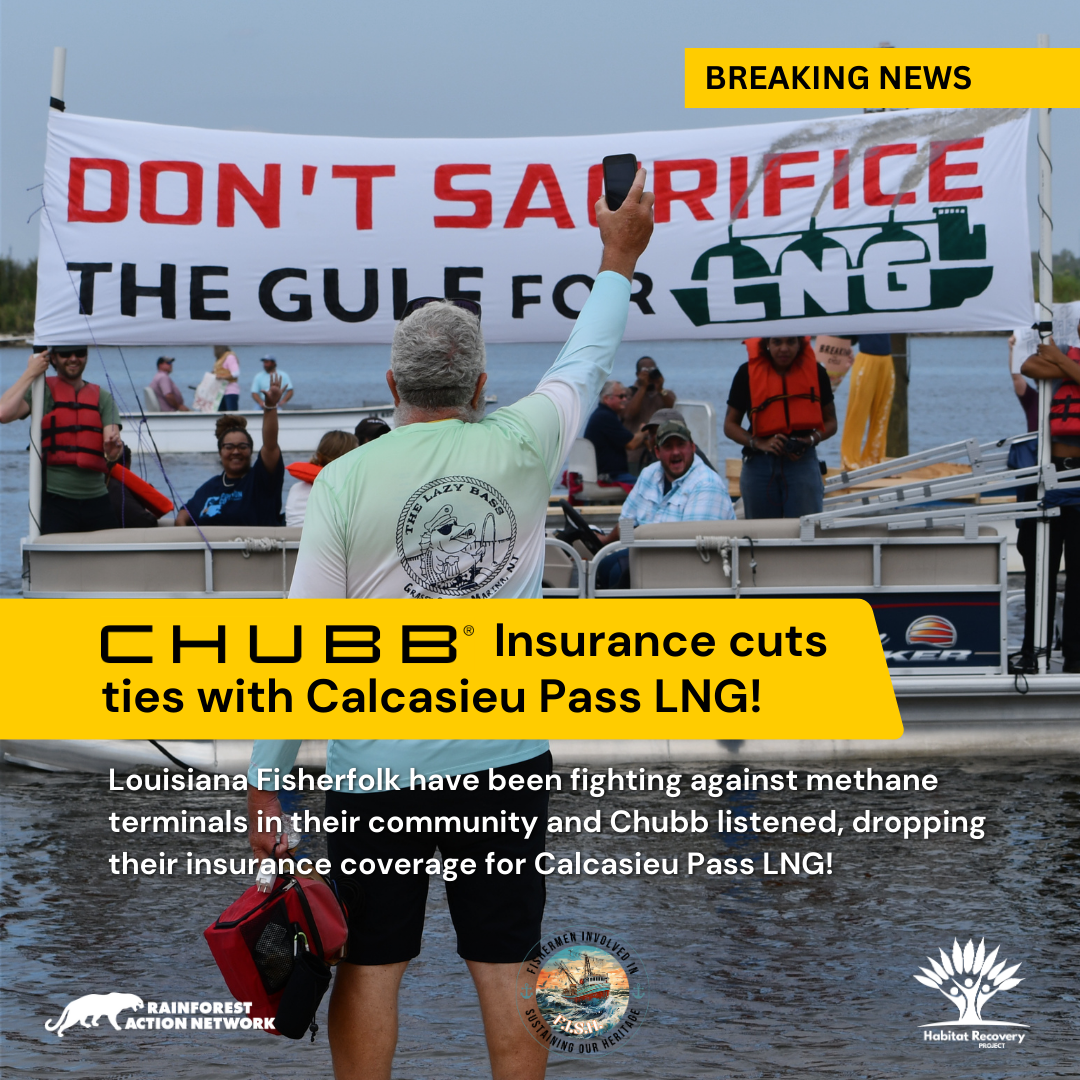

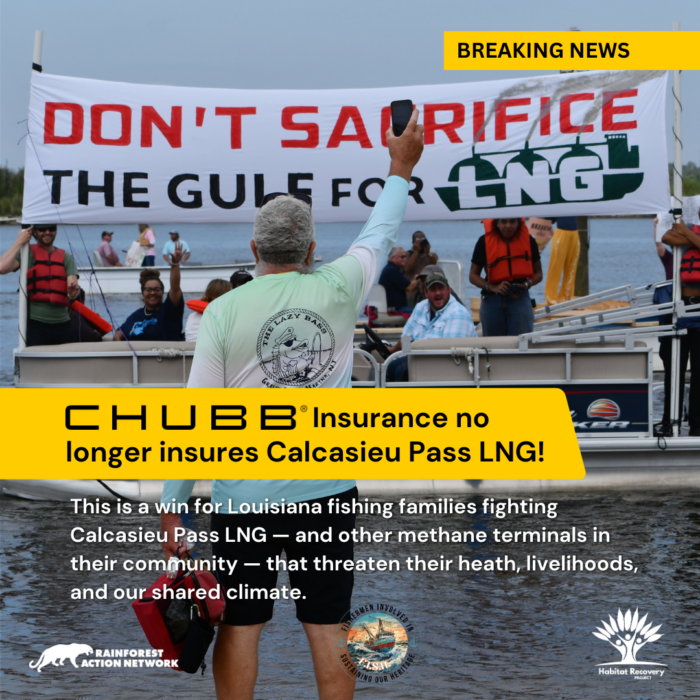

After impacted fishing families, RAN, and global allies exposed major insurer Chubb was insuring one of the biggest methane export terminals in the country, we pulled the new policy and Chubb isn’t on it! Chubb no longer has a $1.5 billion primary insurance policy for Calcasieu Pass LNG. Read the exclusive Inside Climate News story here!

This is a massive win for the fishing communities of Cameron Parish, Louisiana whose lives, health, and livelihoods have been deeply impacted by methane (aka liquefied “natural” gas or LNG) production. But Calcasieu Pass LNG isn’t the only LNG terminal in the area – we must keep the pressure on Chubb to walk away from Cameron LNG before that policy renews on June 1st.

Community resistance and public pressure continues to move Chubb

From exposing the insurers secretly backing Gulf methane, to disrupting their signature golf tournament, to over 130,000 emails in their Board of Directors’ inboxes, full page newspaper ads in their neighborhoods, to fisherfolk sending dozens of personal letters and holiday cards — Chubb has felt the public pressure.

This, coupled with listening to the concerns of community members, it looks to us like resulted in Chubb no longer insuring Calcasieu Pass LNG, in what appears to be a positive pattern for them: after public pressure campaigns Chubb also cut ties with the planned Rio Grande LNG, dozens of oil and gas clients, and ruled out insuring the controversial East African Crude Oil Pipeline (EACOP). But Chubb is still one of the largest fossil fuel insurers in the world, and a top backer of Gulf methane, which is why keeping up the momentum against the neighboring Cameron LNG, Freeport LNG, and all planned and existing methane terminals across the Gulf South is crucial.

Talk is cheap. We need Chubb to take us seriously and stop insuring the methane terminals that make it impossible for fisherfolk like myself to make a living.” – Solomon Williams, Jr., Louisiana oyster fisherman.

Fisherfolk fight back!

Methane terminals pose a direct threat to fisherfolk livelihoods by driving away sea life, polluting the community and making their families sick, and endangering their personal safety when methane tankers sink their boats.

The painful irony is that many fishing families can’t afford insurance to cover these real risks because insurers are withdrawing from climate vulnerable communities while insuring methane terminals next door.

Fishing families have been stewards of the Gulf’s coastal waters for hundreds of years, and are deeply rooted to its preservation. Fishermen Involved in Sustaining Our Heritage (FISH) and over 100 fishing families have been organizing against methane terminals in their bayous and across the Gulf Coast. They’re documenting regulatory violations, filing lawsuits, connecting with the corporations threatening communities, and raising awareness on the massive impacts of LNG. These are our shared demands for Chubb:

- Stop insuring Calcasieu Pass LNG, Cameron LNG, and all methane projects

- Stop insuring fossil fuel expansion

- Work with their fossil fuel clients to transition off of dirty energy

Where to go from here

Right now is a critical time for insurers to stop insuring methane expansion as global LNG markets are disrupted, regulators rubber stamp risks, and losses mount from super powered climate storms.

Recently, the Trump administration fast-tracked permits for methane projects like CP2 LNG, a massive proposed terminal next to Calcasieu Pass LNG, that would be the emissions equivalent of 27 coal fired power plants.

Climate disasters are costing the insurance industry – it’s past time for these so-called “risk experts” to seriously consider the countless risks of methane gas: including to their bottom line. Last summer, US home insurers suffered the worst loss this century due to climate disasters. In the last 20 years, over a third of weather-related insured losses are because of climate change, totaling approximately $600 billion in losses. To put it simply: dropping methane isn’t just good for people and planet, it’s also good for business. Chubb distancing themselves from Calcasieu Pass LNG sends the message to its other insurers AIG, Allianz, Liberty Mutual, Swiss Re, AXA, Toikio Marine, Sompo, Munich Re, and Scor, that this project is not worth the risk.

Remember: these terminals can’t operate without insurance, which is why cutting off their coverage is so vital.

Our collective pressure is working. Help keep the energy up on Chubb’s leadership and take action in solidarity with fisherfolk: demand Chubb CEO Evan Greenberg and Board Directors Frances Townsend and David Sidwell be true climate leaders and drop Cameron LNG before the policy renews this June.